New Tax Thresholds in 2024 Budget

Posted on 17 Jun 2024

The New Zealand government has unveiled its 2024 Budget with a core election promise delivered regarding tax relief of $2.57b through bracket adjustments.

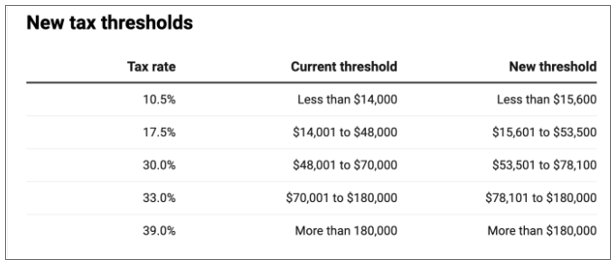

With an adjustment to income brackets, tax rates remain the same but the thresholds are raised.

The Budget stated that 1.9 million households would benefit from the overall relief package by an average of $30 a week. Households with children would benefit by $39 a week on average.

The Independent Earner Tax Credit is being expanded, with the upper limit for eligibility rising from an income of $48,000 to $70,000, with amounts reducing from $66,000+ instead of $44,000+.

A minimum wage worker could expect about $12.50 a week, while superannuitants would take home just $4.50 a week.

National campaigned on enacting these changes at 1 July, but the start date has been pushed back four weeks after advice from Inland Revenue to allow payroll providers more time.

The in-work tax credit will also go up by up to $25 a week from 31 July. National had campaigned on that kicking in from 1 April.The relief package also includes a childcare payment for low-and-middle-income households as already announced.

New Tax Thresholds

Other key government expenditure items in the budget include:

- $155m on Independent Earner Tax Credit eligibility changes in line with National's election campaign

- $182m on In-Work Working For Families Tax credit by $25 a week, in line with National's election campaign

- $729m on restoring interest deductibility for residential rental property

- $45m on adjusting the Brightline Test