The Cashflow Conversion Cycle - Part three

By Kristina Henare

Posted on 21 Feb 2025

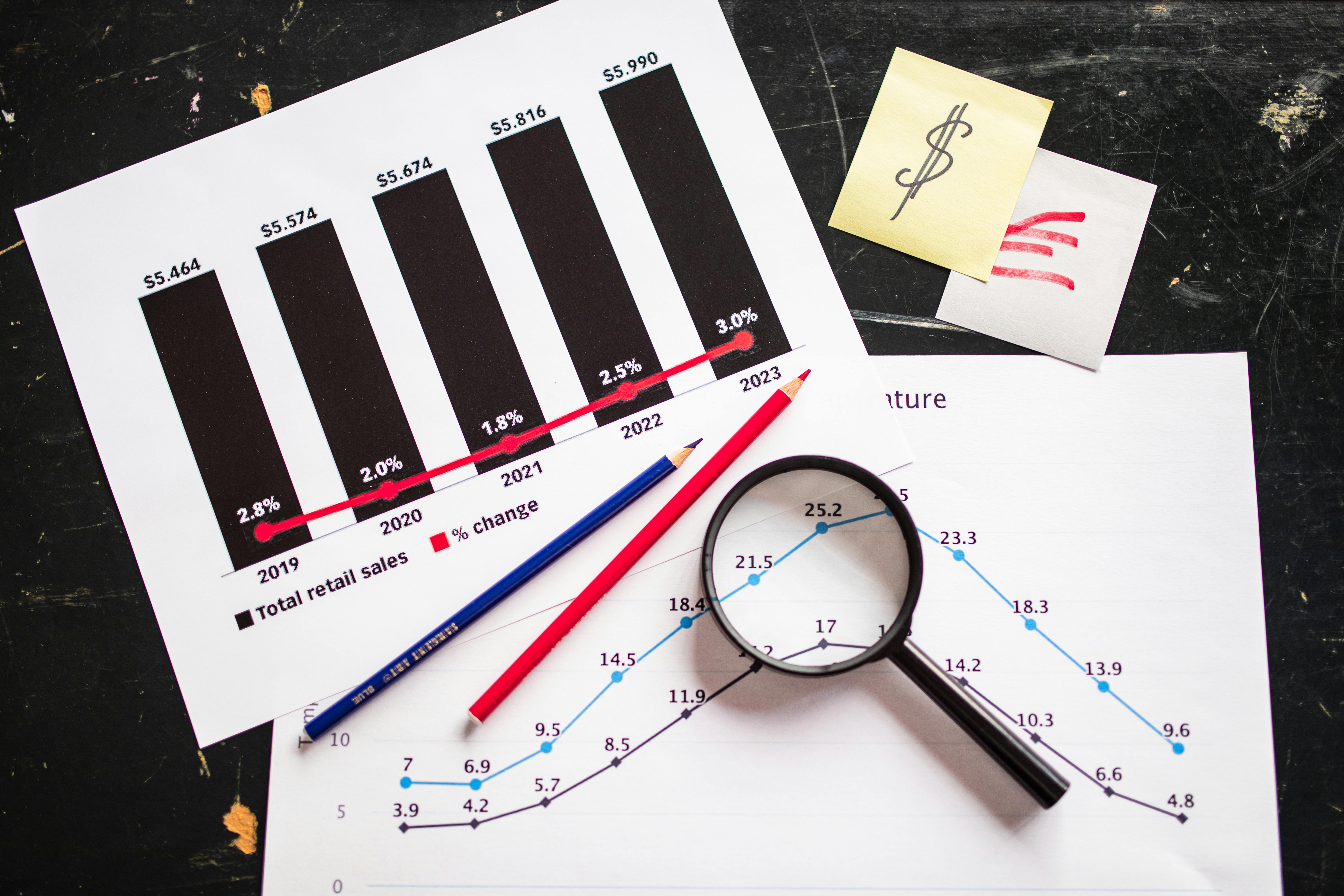

The cash conversion cycle measures how efficiently a retailer converts inventory into cash. It includes the time to sell stock, collect payments, and pay suppliers. A shorter cash conversion cycle means faster cash recovery and better cash availability for the business.

PART THREE

Cashflow and Profit Improvement - The Cash Conversion Cycle

- Why it’s crucial: It measures how efficiently a business manages its inventory, receivables, and payables. It directly impacts cashflow, cash availability, and profitability. A poorly managed cash conversion cycle can lead to cash shortages, reliance on expensive financing, and missed growth opportunities.

- What to do: To improve your cash conversion cycle, start by reducing inventory holding time through better demand forecasting and inventory management. Speed up collections by invoicing promptly, offering early payment discounts, and following up on overdue payments. Additionally, negotiate longer payment terms with suppliers to delay cash outflows without harming relationships.

- Benefit: Optimising your cashflow conversion cycle brings several benefits, including improved cashflow from faster cashflows, which ensures more cash availability to cover expenses and invest in growth. It also lowers financing costs by reducing reliance on loans or lines of credit, saving on interest payments. Efficient inventory turnover and timely collections boost profitability, while a shorter cashflow conversion cycle build financial resilience and support long-term business stability.

We’re here to help you improve your Cashflow Conversion Cycle to enhance cash flow and profitability. By making a few strategic adjustments, we can help you get paid faster, manage inventory smarter, and stretch supplier payments – turning your operations into a cashflow powerhouse.

Talk to us today and let us show you how small changes can lead to big results.